how to calculate nh property tax

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev.

Voted Appropriations minus All Other Revenue divided by Local Assessed Property Value Rate.

. The RETT is a tax on the sale granting and transfer of real property or an interest in real property. All documents have been saved in Portable Document Format unless otherwise. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

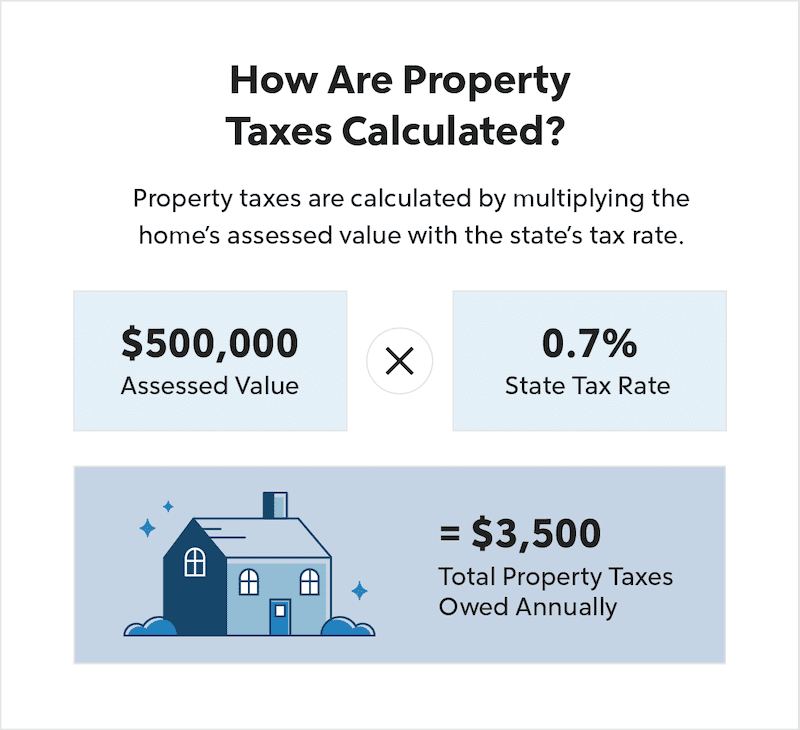

The first way is to multiply your assessed value by your tax rate. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax. Overview of New Hampshire Taxes.

The assessed value of the property 2. If you make 70000 a year. The result is the tax bill for the year.

For example if your assessed value is 100000 and your tax rate is 10000 you will pay 10000 in property. The formula to calculate New Hampshire Property Taxes is Assessed Value x. Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090.

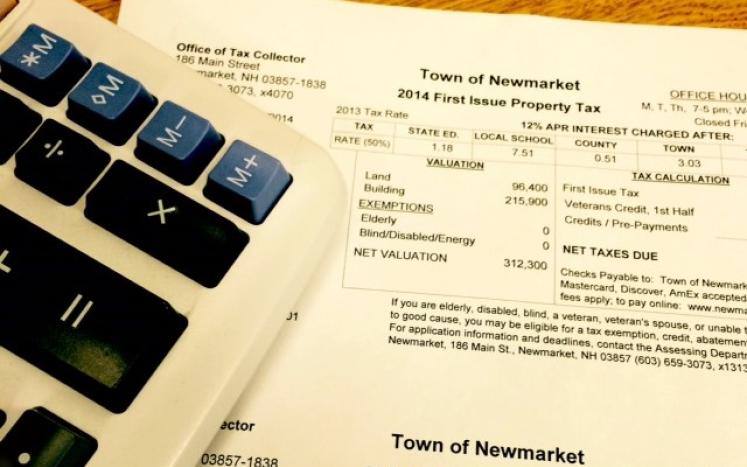

Exemptions New Hampshire state law provides. New Hampshires tax year runs from April 1 through March 31. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by.

186 of home value Tax amount varies by county The median property tax in New Hampshire is 463600 per year for a. NH property tax rates are set in the Fall and are retroactive to April 1st of that same year. For comparison the median home value in New.

For a house assessed at 250000 multiply the value by 2316 and divide by 1000 to get the annual tax bill 5790. New Hampshire Property Taxes Go To Different State 463600 Avg. New Hampshire Real Estate Transfer Tax Calculator The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

Welcome to New Hampshire Property Taxes. New Hampshire Income Tax Calculator 2021. How to Calculate Your NH Property Tax Bill 1.

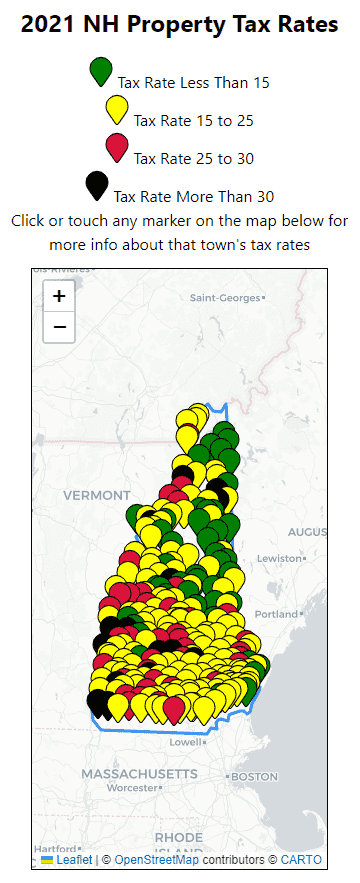

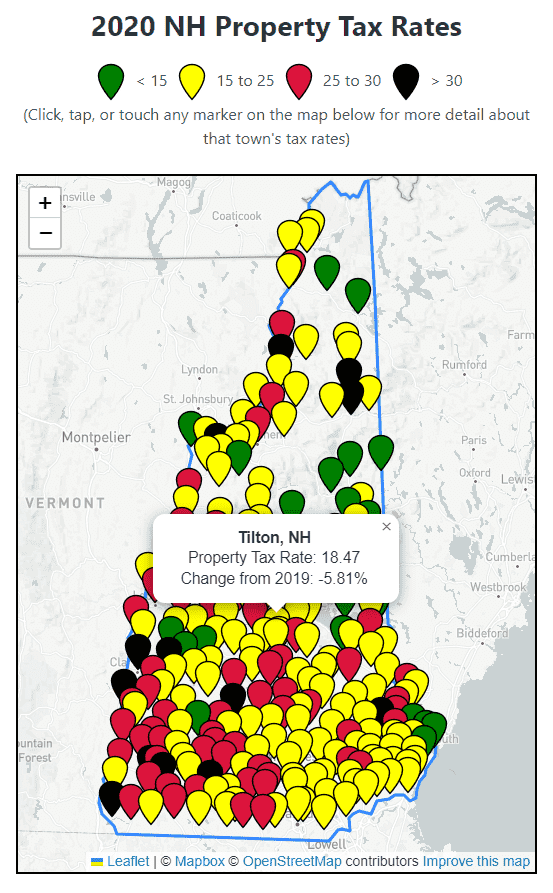

Hebron has the lowest property tax rate in New Hampshire with a tax rate of 652 while Claremont has the highest property tax rate in New Hampshire with a tax rate of 4098. New Hampshire has no income tax on wages though the state does charge a 5 tax on income from interest and dividends. The local tax rate where the property is situated 300000 1000 300 x 2306 6910 tax bill 1.

That information is then used in the formula below to calculate the local property tax rate. Ad Calculate Your 2022 Tax Return 100. Your average tax rate is 1198 and your.

2021 Tax Rate Set Hopkinton Nh

Monadnock Ledger Transcript Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

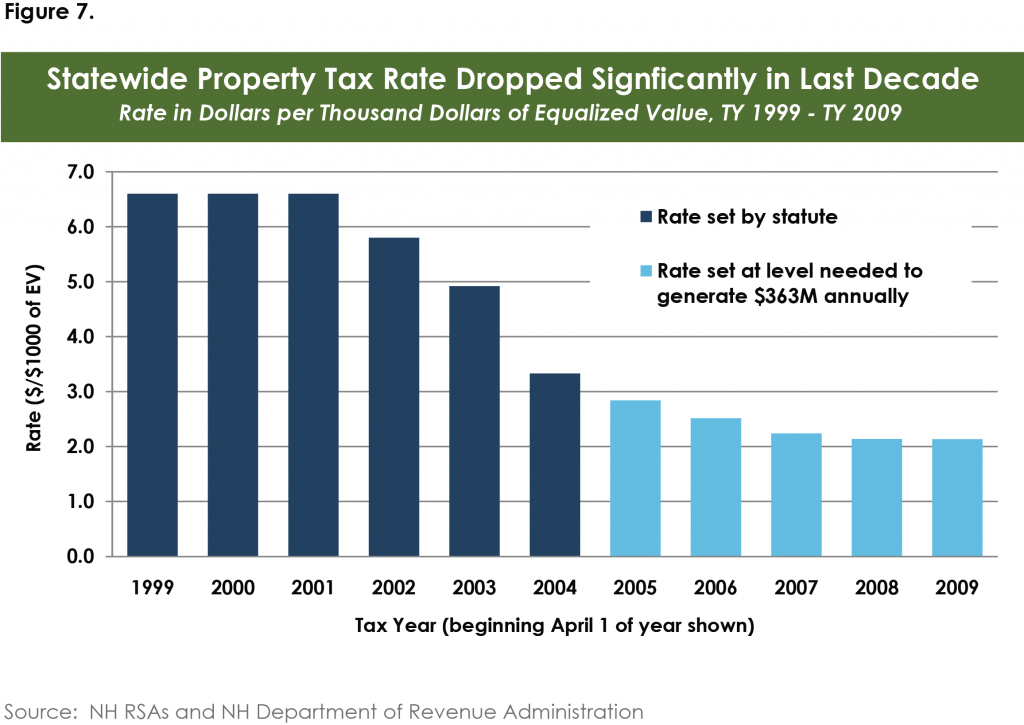

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Calculator Smartasset

New Hampshire Estate Tax Everything You Need To Know Smartasset

Property Tax Bills Town Of New London Nh

Real Estate Taxes Vs Property Taxes Quicken Loans

How To Calculate Property Taxes The Ascent By Motley Fool

What You Should Know About Moving To Nh From Ma

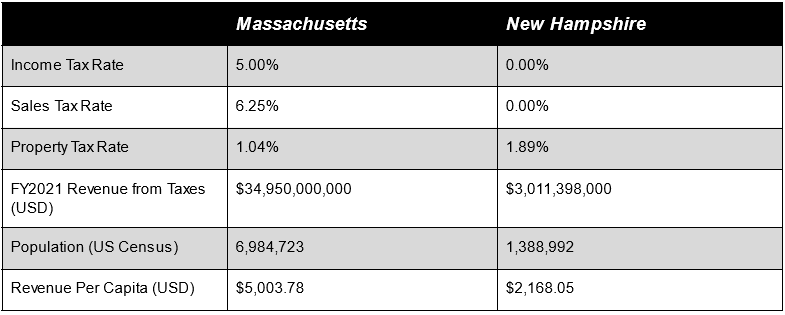

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

Everything You Want To Know About Property Taxes In New Hampshire Concord Nh Patch

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

Nh Property Tax Relief Program Deadline Extended To November Nh Business Review

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

How We Fund Public Services In New Hampshire New Hampshire Municipal Association